| | Case Study |

|

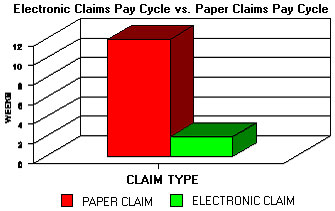

| Paper Claims |

Electronic Claims |

| 45 - 120 days |

7 - 21 days |

| Up to 30+% rejection |

Less than 2% rejection |

| Up to $2 / Claim including postage |

$0.50 / Claim |

| Some errors |

Very Accurate |

| Extensive Follow Up |

Limited Follow Up |

|

|

IF

- Average daily patient volume is 16

- 60% of patients are covered by insurance, and

- The office is open five days a week, 48 weeks per year,

Then

- Total annual insurance claim volume is 2,304.

- Estimate $29,000 in annual salary costs, based on the average wage for one full-time billing assistant, with part-time utilization of a clerk/roving assistant.

Lets Compare-

This example is based on:

- 6 minutes working time on paper claims and 2 minutes for electronic claims,

- Current postage rates,

- Trading partner and clearing house fees up to $2 per claim, and

- OHMS™ fees of $0.50 per claim plus monthly charges.

| Annual Costs |

Paper Claims |

Electronic Claims OHMS™ |

| Staff time for processing and submitting claims |

$3210 |

$1070 |

| Claim Submission and mail postage |

$4618 |

$2304 |

| Staff time for posting, follow-up and claims resubmission |

$2140 |

$21 |

| Claim resubmission and mail postage |

$65 |

$0 |

| Estimated Costs: |

$10,023 |

$3,395 |

Estimated annual savings by using electronic claims = $6,628

|

|

|

| |